Sacrificial Lands

Mining the Minerals to Fuel the Green Revolution & a Post-Carbon World: Impacts, Investments & Necessity

In the beginning

It has been said that mining may not be everything but nothing else would be possible without it. Critical resources have come to be used as shorthand to mark human progress; from the Stone Age, to the Bronze Age, to the Iron Age, to the Information Age. When technology reached a point where the smelting of steel became widespread, economies grew rapidly and humanity shifted from the prehistoric era to the modern. Interestingly large parts of the artisanal mining sector have never moved much beyond these pre-modern advancements. Therefore a great deal of the minerals and metals that make the most sophisticated technologies possible are still obtained in a way that would not be unrecognizable to a miner from thousands of years ago.

Control over resources and dominance of their trade have been important to the economic foundations of societies since the beginning of human civilization. Whether they were precious resources like gold, diamonds or other gems or more critically strategic resources; like obsidian, iron and copper. Control over their dominion was almost always an essential ingredient for civilizational success. The Maya and Inca in the America’s developed vast trading networks and riches, which the Spanish conquistadors were so keen to dominate and plunder upon discovery. The medieval southern African kingdom of Mapungbwe grew into a wealthy city-state, trading mineral resources and other goods throughout the continent and as far away as Arabia, India, and China from the 10th-14th century AD.(1)

Later resource ‘booms’ feverishly lifted cities and whole regions, from obscurity to prominence, sometimes in a matter of months. San Francisco’s population was less than 500 in 1847, but by the end of 1849 following reports of the gold strike at Sutter’s Mill it had swelled to near 25,000. Critical minerals have always played a role in these booms, and their overexploitation, or a sudden crash in value can cause harsh bust cycles to quickly follow. Leaving suddenly prosperous, newly minted communities just as suddenly desolate, abandoned ghost towns, again in the span of mere months. It can be a head spinning whirlwind, as towns like Bodie, CA will attest. A place where people seemingly just up and left in a hurry, mid-meal or on a whim one day, without even bothering to pack.

Black Gold

Gold still holds quite a bit of allure and more value than ever but strategically over time its importance has waned. With the advent of the automobile age and a shift away from gold standards, oil quickly vaulted to the top of the list of commodities considered most critical. Wildcatters, first in Pennsylvania then later in Texas, staked everything on risky ventures and a freewheeling, gambler's mentality held sway. Wars were waged in pursuit of oil or over its access. Somewhere between a quarter and a half of all interstate conflicts since 1973 can be connected to oil, and secure supply chains have come to be considered crucial for national survival. Oil is ostensibly the lifeblood of any modern economy. It was even the US oil embargo on Japan that likely presaged their attack on Pearl Harbor. Access to oil is still an essential fixture of national security and drives policy decisions in capitals the world over. However, with the world on the cusp of an unavoidable and well overdue shift toward renewable energy, the balance of power is moving away from hydrocarbons and towards a new set of critical minerals. Necessary for semiconductors and microchips, satellites and lasers, and critical in every way for computing and data storage, there is no future without critical minerals. If oil is the blood that keeps an economy pumping, critical minerals will be the air it breathes going forward. A question worth pondering is, will the stakes over these newly critical resources be as high and become as contentious as past conflagrations over oil have proven to be.(2)

Green Gold

Everyone is generally familiar with the minerals that have powered the world since the onset of the industrial revolution, first coal and oil and more lately nuclear and natural gas. These are ubiquitous the world over, known to be reliable sources of energy and basically understood, as far as impacts and sustainability are concerned. Less understood are the new class of critical minerals that have gained importance in the last 30-40 years. As the ICT revolution accelerates and the world pivots towards green energy solutions, these unsung minerals have almost invisibly become the crux-point in global commerce and a functioning of modern society. So many of the devices and conveniences taken for granted rely on these minerals, so what are they exactly and what challenges are posed in obtaining ample supplies of each.

Not so Rare Earths

While the term ‘rare earths’ is often misconstrued by many to mean the elements themselves are lacking in abundance, they are not actually all that rare and can be found in abundance in many places around the world. They are just rarely mined and not easy to process. It is highly energy and water intensive and quite damaging to the environment in the long term.

The rare earth elements perplex us in our researches, baffle us in our speculations, and haunt us in our very dreams. They stretch like an unknown sea before us mocking, mystifying and murmuring strange revelations and possibilities. ~ William Crookes

Rare earth elements or REEs are a grouping of 17 minerals that occur together in deposits and are therefore mined in conjunction. Four of the most important of these for the green energy transition are neodymium, dysprosium, praseodymium and terbium. China not only dominates the processing of these elements into usable forms, in some cases like dysprosium 100% of the supply is sourced from China, it also contains substantial REE deposits of its own. In 2010 they controlled approximately 95% of the market in REEs, that is down to somewhere around 60% today, as more production has come online in Australia and elsewhere. The Mountain Pass Mine in California was reactivated in 2018 and is the only current REEs mine in the US providing about 15% of global REE supplies, but it still relies wholly on China to process what it digs out of the ground. China controls 90% of the processing capacity for light REEs and 100% of the processing capacity for heavy REEs. Processing is notoriously dirty as the byproducts are radioactive tailings, and a lot of them, since so much ore must be refined to produce significant quantities of the various minerals. One other concern is the price fluctuations of the various minerals in the group. Since they are mined in conjunction, spikes in demand in a few may not necessarily equate to higher profits for mine operators if prices for others remain low, a leveling out effect can happen since they don’t all rise or fall in tandem. Some 20 new REEs projects in the next few years should begin operations in the US, Canada and Australia which will put further downward pressure on prices as more midstream production capacity opens up. There is also some interesting potential to process coal waste in a way that allows efficient and more environmentally friendly processing, recycling what’s now just a toxic byproduct of coal mining and turning it into usable REEs.(7-8,10-16,30)

Copper Still King

Copper is surely much more familiar to the non-geologists, but its criticality is likely underestimated. Still a superior and an as yet irreplaceable element, prized for its electrical conductivity and malleability. With a long history of being mined and active sites and ample deposits in Peru, Chile, China, the DRC, Zambia, Australia and the United States there wouldn’t, on the surface, appear to be any supply chain problems. Dig deeper though and it becomes apparent that given the upward trajectory of demand and the downward trajectory of productivity, due to the declining quality of the ore and the increasing difficulty in accessing what is available, there could be trouble ahead. China leads by far in both refining and demand for copper, accounting for around 50% of both. Supplies seem strong based on current projections but given the long lead time for projects and the lack of any new mines being planned beyond the late 2020s, concerns exist about long term supply outlooks. Current output meets current demands, but as these supplies inevitably shrink due to productivity loss, and with demand only expected to grow exponentially, finding new sources of ore is imperative or else supply shortages may arise. There’s also the matter of how water intensive copper mining happens to be, crossed with the harsh reality that most deposits are found in arid and already water stressed areas.(16-17,30)

Conflict Cobalt

Cobalt is one of the most crucial elements going forward as the world turns towards renewable energy. It is actually retrieved as a by-product of copper and nickel mining. Their fates are therefore inextricably linked. Currently close to 70% of cobalt is mined in one country, the Democratic Republic of Congo or DRC. A major component of electric vehicle batteries, and with demand for it set to skyrocket, possibly by as much as 40x in the next 20 years, secure supply chains will be essential for any successful green transition. The DRC is a difficult case, seemingly beset by every intractable issue a country could face and a classic reminder of the ‘resource curse’. Facing conflicts both internally and externally, climate threats, predatory business partners, corrupt government officials and a massive land area that is 1/4th the size of the US with very little infrastructure. It is still a difficult place to navigate in all respects, so the DRC is an unlikely focal point for so much of the globe’s future success to hinge, but the world will depend on it. Artisanal mining accounts for a great deal of the current cobalt supply, around 20% by official metrics but the unknown-unknowns of the Congo are legendary, so any number is a guess at best. A couple of large multinational companies do the rest of the mining, one Swiss and one Chinese. Artisanal mining or ASM presents many challenges, child labor is rife, environmental standards are nonexistent, safety is an afterthought, and infiltration by transnational crime organizations is rampant. It’s also often the best or only economic opportunity for isolated communities and industrious individuals. Given the taint associated with ASM, many companies rightfully steer clear of supply chains that originated in Congo. Given the increasing reliance on ever rarer supplies though, this isn’t a long term viability. It’s likely impossible to declare, even now, with any true confidence that minerals from the Congo, minerals surely in some part mined by child labor, aren’t currently deeply embedded in supply chains. Most experts believe some part of every phone, computer, electric car, etc has at least some minerals that would be considered ‘conflict’ as a major component. Blood diamonds are high in the public imagination but blood smartphones or laptops or EVs not so much.(29-30,16-17)

Double Nickel on a Dime

Nickel is another mineral concentrated in certain geographic regions, making supply chains potentially unreliable. Indonesia and the Philippines currently represent 45% of the world’s supply. Used mainly in stainless steel production but also increasingly a major component of electrical vehicle batteries, it’s also a key source of cobalt. Indonesia has shaken up the supply chain the last few years with its sudden ban on exports of raw ore at the beginning of 2020, two years earlier than previously announced. This set in motion a scramble to set up processing plants within Indonesia in order to maintain uninterrupted flows for China’s voracious steel industry. Indonesia had tried a similar plan in 2017 but had to relent due to inadequate smelter capacity, as soon as enough operators became operational the ban was swiftly put back in place, to the seeming surprise of commodity markets. Successfully pulling in billions in new foreign capital, Indonesia sparked consternation from buyers but ultimately capitulation as there are not any better options than meeting their stipulations. They’ve also begun to implement export taxes on various types of processed nickel as well, in an effort to further expand their industrial base and revenues. Their current control over nickel allows them this leeway, since alternatives to their supply are nonexistent. Diversifying this supply chain in the long term is an important step, but as it stands no projects are on the horizon outside of Indonesia, so for now they will remain the only nickel game in town.(30,33-36)

It’s a mining town in a lotus land. ~ F. Scott Fitzgerald

Lithium processing facility in the Atacama desert of Chile -Wikipedia Commons

Lithium Nirvana

Nicknamed ‘white gold’, lithium’s prospects have never looked better as it has the highest demand among any of the critical minerals. Prices are up over 700% since the beginning of 2021. The key component in the efficient lithium-ion battery revolution that has truly changed the world. Making everything from the original iPod possible to the latest Tesla models so fast. Chile and Australia currently have the most active lithium mining sectors and China once again dominates the processing sector, handling about 75% of the total and over 80% of a particular high-end type that is most coveted by battery makers, while also hosting reserves of their own. The US has one functioning mine right now, in Silver Peak, NV but reserves are thought to be plentiful. Demand is being met currently but looking ahead beyond 2030 it’s likely given the emissions targets being set, and the amount of electric vehicle adoption necessary to get there, supply compared to demand will get much tighter in the medium to long term.(21,30-32,37-39)

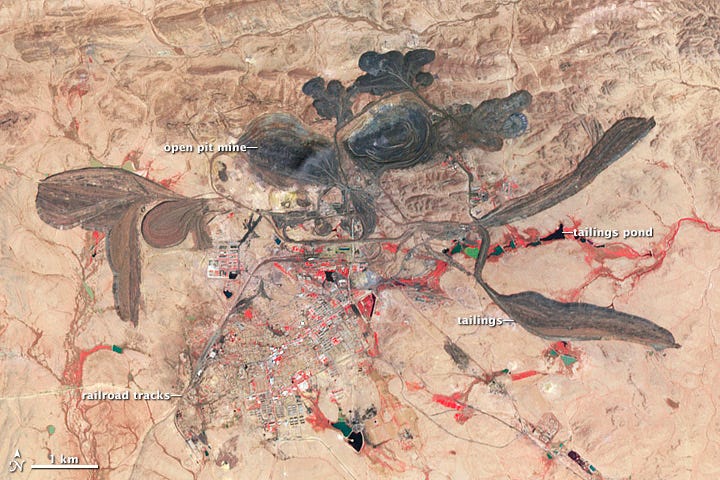

The Bayan-Obo mining district, Inner Mongolia, China, approximately half the world’s REE originate here.

The Middle Kingdom’s Ground

China has many advantages making it possible for it to maintain dominance of the whole spectrum of critical mineral supply chains, from production to processing. The country itself is blessed with an abundant supply of various minerals. What it lacks in domestic oil potential it more than makes up for with access to the whole gamut of critical minerals. Lax regulations and government incentives allow processing to be done far more cheaply than anywhere else. Not only are domestic sources abundant, but China has also aggressively pursued mining opportunities in many corners of the globe whether in Africa or Australia, Indonesia or South America. Unafraid to source from regions and countries that most Western corporations don’t take a risk on, due to the prevalence of conflict, corruption and unregulated ASM mining, which makes them no-go zones legally. Chinese dominance is no accident, it has been a concerted and concentrated effort, arching over many decades of development policy. As far back as 1975 China had a serious state policy in place regarding critical minerals.(10-12,14-17)

It was in 1975 that China founded the National Rare Earth Development and Application Leading Group or simply the RE office. Recognizing the national importance of these elements to future economic development, an aggressive multi-pronged approach was instituted to guide China’s nascent industrial policy and eventual expansion into a global behemoth. The first years offered support to the infant-industry, to help operators gain a foothold in global value chains and to inject much needed cash into the country’s economy. Exports were encouraged and export-tax reimbursements were available to rare earth producers, Japan and the US were both early customers. This led to a doubling in production from 1985-1990. The late 80s and early 90s saw a shift in priorities and policies in the West and Japan, which led to less processing capacity globally and more concentration within China. Concerns over environmental degradation and radioactive runoff were high in Europe and elsewhere. Japan set about offshoring its processing to China, in a move to gain more steady access to supplies and cheaper overall production due to subsidies, while also sparing its own environment. At this stage the Chinese policy was working incredibly well, an abundance of supplies and processing and lack of oversight led to a steady drop in prices. Concern began to grow as time went on over illegally mined elements entering the supply chain though, as these eroded prices ever further. Producers in China would eventually engage in collusion in the early 90s to help stabilize prices.(10-12, 14-17)

At this point the strategic value of the minerals began to be reconsidered, and recognized as more than just a source of foreign capital for China. Foreign investment in upstream production started to be scrutinized and disallowed in most cases, meanwhile investment in downstream production was still actively encouraged. Previously granted mining licenses were revoked, the minerals were officially designated as critical to national security and export controls were put in place. This was meant to help tamp down what was considered over investment in the mining sector and over supply, but considering the amount of illegal mining this only went so far as a preventative measure. As growth overall in China began to skyrocket in the 90s central planners foresaw issues with their earlier rare earth strategy. Environmental damage, long term sustainability and local impacts were already on their radar, as the previous rush for economic development at any cost had caused quite a bit of unchecked exploitation and environmental damage. Foreign investments in mining were further restricted, stricter production quotas implemented and export quotas and taxes introduced. This led to advantages for processors in China, who now had access to cheaper raw materials, which then encouraged foreign firms to shift even more processing to China. At this point close to 60% of mined rare earth material came out of China, around this same time they were admitted to the WTO, further strengthening ties to global supply chains.(10-12, 14-17)

The late 90s and early 2000s saw increased emphasis on export quotas to rein in illegal suppliers and stricter production quotas in a complicated, firm by firm, region by region policy. This pushed consolidation in the industry and led to greater state control over time. Foreign investments were even further curtailed in all sectors, as concerns over the environment and over-exploitation of the non-renewable resources gained attention, from both regional authorities and locals on the ground, who voiced concerns over rampant pollution. Illegal mining also continued to plague Chinese regulators. The success of prior policies actually incentivized illegal miners to continue unabated since prices increased dramatically. Estimates vary over the size and impact of illegal mining, and given the opaque nature of Chinese statistics and the obfuscation inherent to all illegal enterprises, nailing down exact figures is impossible. What is known is that it is definitely not an insignificant source of rare earth elements in China. Some put the number at 25-40% of total national output prior to 2013, coming from illegal sources and that’s from the leader by far in global output. As stricter reforms were enacted some claim that number fell below 20% after 2014 but others say illegal sources still constituted over 50% of the supply chain post-2017. As an example of how blatant this illegal supply was, reported imports of REEs from China by various countries, like Japan, South Korea and the United States were consistently higher than official Chinese export quotas for years at a time. 2009 was actually the only year where the reported export/import numbers aligned worldwide and that was amidst a global financial meltdown and a sharp decline in commodity demand and prices. In any case, China controlled around 97% of the REE markets in 2010, whether or not all sources from the country were accounted for, or all its policies were successful.

In 2010 export quotas were lowered significantly causing a spike in prices that left many international customers of China unable to afford the minerals crucial to their production. China’s two month ban on exports of rare earths to Japan over a dispute in the Senkaku Islands the same year, was meant as a shot across the bow at a regional competitor, but it was perhaps too effective. In the end it seemed to serve as a wake-up call to every country with regards to the implications of Chinese dominance of this critical sector. In some ways this move jump started the global race for rare earths and other critical minerals. Demand for smartphones exploded in this era too and the electric vehicle industry also began in earnest. Two cases were brought before the WTO over China’s export restrictions around this time, and in both cases the challenging parties prevailed, a new era of competition was certainly underway.(10-11, 14-17)

China currently controls much of the critical mineral supply chain and the lack of mining, processing, and recycling capacity in the U.S. could hinder electric vehicle development and adoption, leaving the U.S. dependent on unreliable foreign supply chains. ~Biden Administration in 2022

Vision spurs action and is achieved through action.

~Xi Jingping at 2016 SCO Council

Bayan-Obo mine Inner Mongolia, China ~ Andriy Solovyov - Fotolia

The Beautiful Country’s Landscape

Starting in 2018 the United States began compiling a list of commodities considered critically important to national security. According to Tanya Trujillo, Assistant Secretary of the Interior for Water and Science, “Critical minerals play a significant role in our national security, economy, renewable energy development and infrastructure.” Updated yearly this list, as of 2022, contains over 50 minerals and metals. From the familiar like aluminum, graphite, lithium, platinum, and tin. To the more obscure and less readily available like cobalt, cesium, dysprosium, and all the so-called rare earths. There is only one active rare earth mine in the US, at Mountain Pass, CA and it was only brought back online in 2018. It is still working towards being able to process what it mines though, with most all processing for rare earths done overseas. All of Mountain Pass’ output so far has gone to China for final processing and the US obtains around 78% of its rare earths from China currently. The 50 plus minerals deemed most critical have a wide variety of uses; nuclear power, missile guidance, fiber optics, LED/LCD screens, solar cells, batteries of all kinds, magnets and steel production, are all impossible without stable and consistent supply chains of these elements.(3-4)

Biden’s Executive Order no. 14017 was released early in his term and put a clear emphasis on securing the US supply chain for critical minerals and drastically increasing both mining and processing in the country. His order built upon others from prior administrations and is among a basket of proposals to build out a reliable US-based supply chain. Covid-19 exposed vulnerabilities to an over-reliance on extended supply chains and just-in-time shipping. Especially with regards to such essential base minerals. While they are basically invisible, without them none of the modern amenities we take for granted like smartphones, electric vehicles, powerful computers, widespread internet connectivity or even electricity would be possible. The recently released National Security Strategy may not have explicitly mentioned mining and minerals and their fundamental importance, but reading between the lines most of the goals and strategies revolve in some way around ready access to them. One recent example of this obvious criticality was the temporary halting of F-35 production due to concerns over a magnet alloy sourced from China.(5-9,27)

US policymakers want to reformulate policy and jump start a mining boom within its borders, but high level thinking and big plans don’t often translate to practical solutions. China’s head start has allowed it to build out all the necessary infrastructure and tweak policy as they’ve gone along, making it ever more effective and precise. The US is a tortoise joining the race late, with a Chinese hare that has a huge head start. While the US is most certainly starting from far behind it can’t allow this factor to cause it to be overly strident or make imprudent plans. At the same time the US does need to start running, since it already missed the starting gun, relying solely on tripping China as a way to catch up is not a sensible strategy.

Silver Peak, NV site of the only US lithium mine. -CBS News

Recent legislation such as the Inflation Reduction Act and CHIPs Act and use of the Defense Production Act by the Pentagon, squarely target a new brand of industrial policy for the United States.. Targeting something, versus actually hitting the mark though, are two very different things. It takes steady effort and careful aim to make the right impact. The US may want to drastically diversify supply chains for critical minerals but there’s several hurdles standing in the way.

First there’s the matter of the outdated mining laws which were drafted 150 years ago, so obviously fail to factor in modern needs or technologies. There’s also the exceptionally long lead time for mining projects that needs to be considered. Plans of this magnitude, with so much upfront investment (10s of billions) and scale of work (years of assessments before ground can be broken), take well over a decade to bring fully online. Delays in permitting in the US can add years to already years-long initiatives and the pendulum swing of political priorities make venturing into a mining project that much more risky and costly in the US. While quotidian corruption may not be the issue it is in other countries, operators in the US still face a monumental morass of red tape before ever breaking ground. Ensuring environmental responsibility obviously needs to remain a top priority but interminable delays can’t be allowed to stymie such a critical industry. More focus should be put on shovel-ready projects, many of the proposals being put forth are still for pilot or demonstration programs.

There is however positive progress being made on various fronts and the significant incentives being offered appear to already be paying dividends. Nearly $7 billion is being invested to increase battery production within the US. With companies like MP Materials being one of the beneficiaries. Having recently reported a doubling in earnings and making ambitious plans to onshore all processing of REEs mined at Mountain Pass, to a California plant by the end of this year. The company is also about to finish a magnet factory in Texas as well. Other mines and processing facilities are in the works, with more lithium mines planned in Nevada, North Carolina and Imperial County, California and processing plants in the works in Arizona, Minnesota and Michigan. Apple and Tesla have also announced plans to onshore much of their supply chains to the US in coming years. The same thing is happening with semiconductors with several large manufacturing facilities in the works in Ohio and other parts of the Midwest. All of these will need consistent and secure access to dozens of critical minerals.(5,21-25,31,37,40)

Recycling is another area the US is emphasizing. It's possible to keep the critical minerals we already do have, in our pockets or castoff in closets and drawers, out of landfills and continue to reuse them for decades to come. On that same front, stockpiling of strategic minerals for lean times and to counter wild market dynamics is another pillar of the Biden plan.(22,28)

Another comparative advantage the US has is its strong network of allies and trading partners. The Pentagon has been pushing partnerships with Australia and the United Kingdom to develop more processing capacity to diversify supply chains. It has also called on Australia to review foreign (i.e. Chinese) investment in its mining sector, which it has recently vowed to do. One concern the US has beyond China’s domestic dominance of the critical mineral supply chain, is all the various ownership stakes and mineral rights it has acquired globally. Chinese companies often have significant stakes in overseas mining and processing ventures, whether in Africa, Australia, South America or Indonesia. This complicates matters with the new laws requiring Chinese-free supply chains. Entanglement is such and supplies of certain minerals are so concentrated geographically, that total decoupling is all but impossible. This cuts both ways though, even with China’s overall dominance there are critical facets of the industry that they don’t control, but still rely upon, so export bans as a weapon won’t work for either side.(43-45,25-29)

US partnerships in the EU and elsewhere, with both governments and corporations, can prove to be fruitful, yet also need to be continually nurtured. France is already expressing concerns over Biden’s new industrial policy, likening it to the Chinese one that led to their early lead, but seemingly that is exactly the point. Biden’s new policies have even raised the ire of Chinese commentators, who criticized Canada for doing the “bidding” of the US (again) in an ironic turnabout.(20,46)

On the sidelines of the recent G-20 meetings in Indonesia it appears that many of the concerns surrounding critical minerals were addressed. Leaders grappled with the implications of Biden’s legislative victories over the summer that brought to life his nascent industrial policy. The Partnership for Global Infrastructure and Investment (PGII) was touted as part of a global plan to tackle climate change and meet Sustainable Development Goals. Some projects under its rubric include moves towards more efficient grids, sustainable mining projects, and increasing digital access and financing for SMEs in the developing world.(41)

The EU, as a bloc, needs to reckon with its own divisions and come to a consensus on a path forward to maintain critical mineral supplies. The newly hawkish attitude from Washington towards Beijing has certainly raised eyebrows in Germany. National security concerns from the US side have forced many companies that export to the US market to make hard and often expensive choices, since the Chinese market is also a critical one for them as well. Some are resorting to siloing of their supply chains to serve both simultaneously, but this is costly and leaves SMEs at a supreme disadvantage, margins are often thin so building out multiple supply chains isn’t an option for many companies. SMEs are the backbone of the German and therefore EU as a whole's economy, so this figures into the political calculus in Berlin and Brussels. Keeping their own industrial bases humming and people employed is of the utmost concern. There’s also a lot of rightful skepticism regarding US reliability, as many companies and governments who had been solid partners got burned badly by the Trump administration’s abnormal geopolitical gyrations. Questions about the outcome of the 2024 US election and the direction it will take weighs heavily on decision makers and potential partners, leaving many no choice but to hedge their bets with China, just in case.

On the Ground

China’s overwhelming success with critical minerals and their commanding lead as both a global supplier and consumer would not be possible without large amounts of overseas investments in infrastructure and aggressive pursuit of new supplies near and far. While being a top down approach on the one hand, on the other it unleashed a torrent of chaotic and sometimes overlapping/unproductive projects, so waste was unavoidable. Western investors tend to approach large-scale investments like mines quite cautiously and then respond quickly to market conditions. Commodity markets by their nature are subject to wild fluctuations, so counting on consistent returns is just not possible, but try telling that to shareholders. The Chinese investment approach to mineral extraction differs in that when they come to town, they are in it for the long haul. Domestic demand is such in China that even with a downturn in price they still need raw material, so they will continue operations through a recession or sudden swing in a particular mineral’s price. Whereas Western companies will pull back on production or shut down altogether if the market is not in their favor. This whipsaw retrenchment approach, tied to market swings, is hard on the local labor force. Chinese mines on the other hand will keep operating so their local employees stay employed.(17)

A lack of oversight and more independence allows Chinese operators to be more flexible with local demands as well. A Swiss manager in Africa, for instance, is held in check by a board, obligations to shareholders, and a strong regulatory regime at home, so they just cannot possibly get done what a Chinese manager freed from all these strictures can. Chinese brokers in Africa are also open to buying artisanally mined minerals and then just plugging them into the supply chain. Western companies are bending over backwards to make sure their supply chains don’t even come close to touching these minerals, at least not while they are in the problem countries. Run the same ore through a few midstream processors and muddle its origins, thereby making it impossible to tell what minerals are from where, and with enough inured blindness no one is the wiser. Chinese mining operators are also being backed by a concerted cyber campaign against competitors. The Australian company Lynas reports battling bot attacks on a daily basis, in what is a new front in back-handed business tactics.(17,19)

Lynas mine in Kalgoorlie, Australia ~ Bloomberg

In the Ground

Artisanal mining (ASM) and its impacts are difficult territory to navigate, moral quandaries abound and many a philosophical paradox is brought forth to ponder. There’s no doubt that mining of any kind is a dirty and dangerous business. Whether in the best regulated and safest mine, run by the most responsible multinational corporation or not. ASM makes up a major proportion of the economy of some countries and many regions rely almost solely on it. At the same time it can have absolutely devastating effects on communities, with environmental damage going unchecked and unmitigated, child labor and other forms of exploitation are rampant and safety is not of any concern. It is also an inefficient use of resources and can leave mining sites unusable in the future due to improper mining practices. The amount of ASM going on currently and the percentage it already makes up of global output, perhaps 25% or more with some minerals, makes it an undeniable reality in any post-carbon world.(17,29,49)

Poverty is the parent of revolution and crime. ~ Aristotle

Artisanal gold miners in the Democratic Republic of Congo ~ Robert Carruba

Liminal Spaces & Criminal Cases

Transnational crime is another undeniable fact of the global mineral supply chain that must be considered. Given the amount of artisanal mining, the exploding value of the minerals and the easy obfuscation possible in mineral supply chains, criminal actors are almost certainly already deeply enmeshed. Gold has long been used in money laundering schemes and that has only become more prevalent as prices have spiked in the last two decades. Many of the critical minerals have seen massive spikes in value the last few years, which opens the door to opportunists of all kinds. Private military contractors like Russia’s ‘Wagner’ group are known to be operating in and around artisanal mines in Africa, extracting value and exploiting people in every way possible. In South America drug smugglers operate brazenly in the mineral supply chain. Through complicated schemes involving shell companies and forged documents, gold is shuffled seamlessly into the global supply chain and cash comes back clean. Cartels are even known to be operating the ubiquitous “We Buy Gold” stores that have cropped up in nearly every town in America since the Great Recession of 2008, turning dirty money into gold and then back into clean money when the gold is resold to processors. Theft of catalytic converters from vehicles is another crimewave sweeping the US that can be connected directly to the demand for critical minerals. There is very little reporting currently on criminal activity in critical mineral supply chains outside China (or inside for that matter), but gangs there have long controlled black markets and illegal mines. To think the same won’t happen in other countries and regions with poor governance and a lack of oversight as the value and scarcity of these minerals continues to increase would be naive.(12,18)

The Race with No End

The framing for the pursuit of minerals is often put into the context of a ‘race’ but that presupposes winners, losers and a finish line. The rush to go green and develop renewable and more efficient sources of energy and ever faster more powerful computers, is just the way forward. The climate connection ties everyone on the globe together, in hopes of a victory or in a shared loss, because the alternative is an untenable planet on which to dwell. The US may be starting late but at least the recognition of the necessity for swift action is now an imperative.

The complexities and interconnections of mineral supply chains and the needs for renewable energy will only increase exponentially going forward. Managing an industrial policy that encompasses so many moving parts, spans all points of the compass, involves highly technical processing at every level, and exceptionally long lead times will not be a simple task. China has a nearly 50 year head start and has been tweaking policy to fit the moment all along. Leapfrogging to play catch-up is not impossible though. As technology improves, rapidly moving forward with the latest advancements and utilizing what the Chinese have learned from decades of policy will give new operators an advantage of sorts. Chinese BRI investments in overseas infrastructure have actually fallen off since 2017, except in the realms of ICT and security/surveillance technology which remain strong. A recent move away from the BRI towards the Global Development Initiative (GDI) and Global Security Initiative (GSI) represent a shift, somewhat, in Chinese policy. What that will mean for investments on the ground and supply chain security overall remains to be seen, their notion of “indivisible security” is very vaguely defined currently. So much capital has been committed and plenty of projects have broken ground already in Africa, Australia, and Indonesia that there will not be a significant shift anytime soon away from a China-led supply chain.(47-48,50)

For US policymakers and corporations the path forward is clear. Given current deficits in both upstream, midstream and downstream production, building out a resilient ecosystem of raw ore supplies all the way through to finished workable alloys and metals is crucial. Efforts are underway to map US geologic deposits for the various critical minerals to get an idea of how much actually exists within the US. Some projections of global supplies over the next 20-40 years for the most critical minerals seem to indicate there may not be enough of these minerals in existence to even meet demand in the future. Reliance on technology yet to be invented is the gamble the globe must make going forward it seems. There are promising experiments ongoing to recover minerals from deposits on the seafloor. It is possible enough minerals exist at the bottom of the ocean to power a planetary transformation into a post-carbon future. There are also some scientific advancements in recycling coal ash waste and using that as a source for critical minerals. Combined with aggressive e-waste recycling programs many of these minerals can be recovered and reused repeatedly, eliminating the need for costly and environmentally damaging mining projects.(16)

In the meantime it behooves the US, and every country for that matter, to develop a realistic plan of action in the face of these facts. Finding more sources of minerals that can be sustainably obtained is one pillar. Another is education; ensuring the engineers, geologists, and chemists needed for this transition exist and are being educated in universities is key. Education of the general public is necessary as well, since many have no idea of the stakes but everyone is a stakeholder now. Developing new sources of ore is important but so is proper management of the known deposits and active mining sites. Locking whole regions and countries out of the value chain due to the presence of artisanally mined minerals is not a sound or even feasible policy. It stymies the people living there unfairly and merely opens the door to illegal mining with no rules or standards whatsoever. The vacuum left in these areas when major multinationals leave, is a void that is quickly filled by militias, criminals, or jihadists. Coherent strategies with realistic outlooks on ASM and its inevitability need to be adopted.

The new US industrial policy is a promising start, it seems as if there is finally recognition from both Democrats and Republicans that ceding the whole space to China is not a workable approach. There was no actual strategy from the West until very recently with regards to critical minerals, other than letting market forces play out and the chips fall where they may. Covid-19 disruptions and China’s recalcitrant stance of late has thrown into sharp relief the need for a diversification of supply chains of all kinds. From advanced microchips to basic medicines, an overreliance on just-in-time shipping and stretched supply chains led to severe shortages. As the US now shifts towards what looks to be a divided government, with Republicans in control of the House, the question for our partners and allies becomes will the US continue clearly on the path of progress. Or is divisiveness once again going to divert attention away from the true threats facing the country. Debates over the debt ceiling could lead to a long shutdown of the government much like in 1994, this will only serve to further shake the confidence of US allies. Demands for austerity at any cost from the right over deficits and the desire to chalk a win of any sort, could deflate the impact of Biden’s recent legislative victories. While hawkishness against China may be overblown on both sides it does represent the one arena where there is some agreement. Countering a perceived threat and bolstering national security are major parts of the new US industrial policies, whether this can be kept separate from partisan politics remains to be seen. A lot of trust in the sanity of centrist Republicans has evaporated both here in the US and abroad, and no one perceives the extremes of either party as viable. Restoring faith in the US as a reliable partner will take time and demonstrating to potential partners a bipartisan commitment for future endeavors is essential.

China isn’t immune to uncertainty either, while Xi Jingping coasted into a third term seemingly effortlessly, keeping the trajectory of growth moving ever upwards will increasingly be a challenge. The “Zero Covid” policy may be necessary due to lack of vaccination among the elderly and the questionable efficacy of their vaccines, but it is causing a great deal of damage on a daily basis. Not just psychologically among citizens locked in their homes but among Western companies forced to navigate the unknowns of endless restrictions and shutdowns as well. The latest reports out of China indicate a visceral anger rising among the citizenry, with protests becoming more brazen and widespread by the day. The situation in Hong Kong just prior to the pandemic has not been forgotten either. Many Western businesses have been moving on to more friendly and predictable locales in Asia, and millions of Chinese citizens have left or are planning to. The competition for China will therefore be coming from both internal and external forces for the time being. The US may not even need to bother trying to “trip” China in an effort to catch up as it seems to have erected many self-limiting stumbling blocks of its own already.

We are certainly nowhere near the ‘end of history’, as a whole new great game gets underway. Yet with the US enacting sweeping industrial policy and widespread recognition of the stiff headwinds the West faces going forward, this could very well be the end for neo-liberalism as an overarching strategy of world order.

~ J.C. Williams 11/28/2022 ~

References:

1~ UNESCO World Heritage Centre. (n.d.). Mapungubwe Cultural Landscape. https://whc.unesco.org/en/list/1099/

2~ Walt, S. M., Arreguin-Toft, I., Walt, S. M., Kayyem, J., Giani, L., & Russell, C. (2013, October). Oil, Conflict, and U.S. National Interests. Belfer Center for Science and International Affairs. https://www.belfercenter.org/publication/oil-conflict-and-us-national-interests

3~ U.S. Geological Survey Releases 2022 List of Critical Minerals | U.S. Geological Survey. (2022). https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals

4~ Jacopo Dettoni. ‘Rare earths are not that rare.’ The Financial Times Ltd. https://www.fdiintelligence.com/content/interview/rare-earths-are-not-that-rare-81560

5~ The White House, (2022, February 22). FACT SHEET: Securing a Made in America Supply Chain for Critical Minerals. The White House. https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/22/fact-sheet-securing-a-made-in-america-supply-chain-for-critical-minerals/

6~ The White House, National Security Strategy. (2022, October). whitehouse.gov. https://www.whitehouse.gov/wp-content/uploads/2022/10/Biden-Harris-Administrations-National-Security-Strategy-10.2022.pdf

7~ U.S. Department of Defense. (2020, November, 17). DOD Announces Rare Earth Element Awards to Strengthen Domestic Industr. https://www.defense.gov/News/Releases/Release/Article/2418542/dod-announces-rare-earth-element-awards-to-strengthen-domestic-industrial-base/

8~ Rare Earths, Scarce Metals, and the Struggle for Supply Chain Security. (2022, March). Foreign Policy Research Institute. https://www.fpri.org/article/2022/03/rare-earths-scarce-metals-and-the-struggle-for-supply-chain-security/

9~ Losey, S. (2022, September 7). Pentagon suspends F-35 deliveries over Chinese alloy in magnet. Defense News. https://www.defensenews.com/air/2022/09/07/pentagon-suspends-f-35-deliveries-over-chinese-alloy-in-magnet/

10~ Hart, B. (2021, May 12). Does China pose a threat to global rare earth supply chains? ChinaPower Project. https://chinapower.csis.org/china-rare-earths/

11~ Shen, Y., Moomy, R., & Eggert, R. (2019, March 19). China’s public policies toward rare earths, 1975–2018. https://link.springer.com/content/pdf/10.1007/s13563-019-00214-2.pdf

12~ Wenyi Yan et. al. Criticality Assessment of Metal Resources in China. June 2021, Criticality Assessment of Metal Resources in China. June 2021

13~ “Biden Awards $2.8 Billion to Boost U.S. Minerals Output for EV Batteries.” Kitco News, 19 Oct. 2022, www.kitco.com/news/2022-10-19/UPDATE-2-Biden-awards-2-8-billion-to-boost-U-S-minerals-output-for-EV-batteries.html.

14~ Westcott, Ben. Breaking China’s Grip on Rare-Earths Markets a ‘Pipe Dream,’ Australia Says. 31 Oct. 2022, https://www.bloomberg.com/news/articles/2022-10-31/breaking-china-s-rare-earths-grip-a-pipe-dream-australia-says?leadSource=uverify%20wall

15~ Maughan, Tim. “The Dystopian Lake Filled by the World’s Tech Lust.” BBC Future, www.bbc.com/future/article/20150402-the-worst-place-on-earth.

16~ Sanderson, Henry. Volt Rush: The Winners and Losers in the Race to Go Green. Oneworld Publications, 2022.

17~ Lee, Ching Kwan. The Specter of Global China: Politics, Labor, and Foreign Investment in Africa. Illustrated, University of Chicago Press, 2018.

18~ Weaver, Jay, et al. Dirty Gold: The Rise and Fall of an International Smuggling Ring. PublicAffairs, 2021.

19~ “China-linked Bots Attacking Rare Earths Producer ‘Every Day.’” The Japan Times, 27 Aug. 2022, www.japantimes.co.jp/news/2022/08/27/business/china-bots-rare-earths.

20~China Daily. “Canada Does US Bidding Again: China Daily Editorial.” Chinadaily.com.cn, https://global.chinadaily.com.cn/a/202211/04/WS63650cbaa3105ca1f227423d.html

21~ Kaplan, Deborah Abrams. “How The US Plans to Transform Its Lithium Supply Chain.” Utility Dive, 1 Nov. 2022, www.utilitydive.com/news/us-strengthening-lithium-supply-processing-ev-batteries/635338.

22~“Biden-Harris Administration Announces Nearly $74 Million to Advance Domestic Battery Recycling and Reuse, Strengthen Nation’s Battery Supply Chain.” Energy.gov, www.energy.gov/articles/biden-harris-administration-announces-nearly-74-million-advance-domestic-battery-recycling.

23~ Sloustcher, Matt. “MP Materials to Build U.S. Magnet Factory, Enters Long-Term Supply Agreement With General Motors.” MP Materials.com, 9 Dec. 2021, https://mpmaterials.com/articles/mp-materials-to-build-us-magnet-factory-enters-long-term-supply-agreement-with-general-motors/

24~ “MP Materials Profit More Than Doubles on Higher Rare Earths Prices.” Reuters, 4 Aug. 2022, www.reuters.com/markets/commodities/mp-materials-profit-more-than-doubles-higher-rare-earths-prices-2022-08-04.

25~ “Biden Administration, DOE to Invest $3 Billion to Strengthen U.S. Supply Chain for Advanced Batteries for Vehicles and Energy Storage.” Energy.gov, www.energy.gov/articles/biden-administration-doe-invest-3-billion-strengthen-us-supply-chain-advanced-batteries.

26~ Scheyder, Ernest, and Ernest Scheyder. “Pentagon Asks Congress to Fund Mining Projects in Australia, U.K.” Reuters, 12 May 2022, www.reuters.com/markets/commodities/pentagon-asks-congress-fund-mining-projects-australia-uk-2022-05-11.

27~ Trump Administration. “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals.” commerce.gov, 2020, www.commerce.gov/sites/default/files/2020-01/Critical_Minerals_Strategy_Final.pdf.

28~ Timmer, John. “Toxic Cleanup Technique Can Get More Rare Earth Metals Out of Ores.” Ars Technica, 3 Nov. 2022, https://arstechnica.com/science/2022/11/toxic-cleanup-technique-can-get-more-rare-earth-metals-out-of-ores/

29~ Pecquet, Julian. “US Looks to Africa to Diversify Supply Chain for Critical Minerals.” The Africa Report.com, 10 Oct. 2022, www.theafricareport.com/243847/us-looks-to-africa-to-diversify-supply-chain-for-critical-minerals.

30~ “The Role of Critical Minerals in Clean Energy Transitions – Analysis.” IEA, www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions.

31~ “NATIONAL BLUEPRINT FOR LITHIUM BATTERIES 2021–2030.” energy.gov, June 2021, www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf.

32~ Whitehouse, David. “European Governments in ‘Dreamworld’ on Lithium Supplies, Africa Has the Solution Says AfriTin.” The Africa Report.com, 5 Oct. 2022, www.theafricareport.com/246292/european-governments-in-dreamworld-on-lithium-supplies-africa-has-the-solution-says-afritin.

33~ The National Bureau of Asian Research. “Indonesia’s Nickel Export Ban: Impacts on Supply Chains and the Energy Transition.” The National Bureau of Asian Research (NBR), 18 Nov. 2022, www.nbr.org/publication/indonesias-nickel-export-ban-impacts-on-supply-chains-and-the-energy-transition.

34~ Listiyorini, Eko. “Export Ban Triples Nickel Investment in Indonesia’s Morowali.” Bloomberg, 29 Sept. 2022, www.bloomberg.com/news/articles/2022-09-29/export-ban-triples-nickel-investment-in-indonesia-s-morowali.

35~ Gupta, Krisna. “Indonesia’s Claim That Banning Nickel Exports Spurs Downstreaming Is Questionable.” The Conversation, 30 Mar. 2022, https://theconversation.com/indonesias-claim-that-banning-nickel-exports-spurs-downstreaming-is-questionable-180229

36~ Nangoy, Fransiska, and Bernadette Christina. “Indonesia to Issue Nickel Export Tax Rules in Q3 -official.” Nasdaq, 1 Aug. 2022, www.nasdaq.com/articles/indonesia-to-issue-nickel-export-tax-rules-in-q3-official.

37~ Stevens, Pippa. “Inside the Only Lithium Producer in the U.S., Which Provides the Critical Mineral Used in Batteries by Tesla, EV Makers.” CNBC, 14 Oct. 2022, www.cnbc.com/2022/10/14/lithium-for-tesla-evs-batteries-touring-silver-peak-nevada-.html.

38~ CBS News. “Batteries and the New ‘Lithium Gold-rush.’” CBS News, 7 Nov. 2021, www.cbsnews.com/news/batteries-and-the-new-lithium-gold-rush.

39~ Rushton, Kim. “Demand for Lithium: Is Nevada’s Modern Mining Industry the Answer?” Innovation News Network, 5 Aug. 2022, www.innovationnewsnetwork.com/demand-lithium-nevadas-modern-mining-industry/24125.

40~ Energy.gov, www.energy.gov/articles/biden-administration-doe-invest-3-billion-strengthen-us-supply-chain-advanced-batteries.

41~ House, The White. “FACT SHEET: Presidents Biden, Widodo, Von Der Leyen, and G20 Announce G20 Partnership for Global Infrastructure and Investment Projects.” The White House, 15 Nov. 2022, www.whitehouse.gov/briefing-room/statements-releases/2022/11/15/fact-sheet-presidents-biden-widodo-von-der-leyen-and-g20-announce-g20-partnership-for-global-infrastructure-and-investment-projects.

42~ Energy.gov, www.energy.gov/articles/biden-harris-administration-announces-nearly-74-million-advance-domestic-battery-recycling.

43~ Caminiti, Susan. “After the CHIPS Act: U.S. Still Has a Long Road Ahead to Rival Asia in Semiconductor Manufacturing.” CNBC, 2 Aug. 2022, www.cnbc.com/2022/08/02/after-chips-act-us-has-long-road-to-rival-asia-in-semiconductors.html.

44~ “Inside the Only Lithium Producer in the U.S., Which Provides the Critical Mineral Used in Batteries by Tesla, EV Makers.” CNBC, 14 Oct. 2022, www.cnbc.com/2022/10/14/lithium-for-tesla-evs-batteries-touring-silver-peak-nevada-.html.

45~ “Pentagon Asks Congress to Fund Mining Projects in Australia, U.K.” Reuters, 12 May 2022, www.reuters.com/markets/commodities/pentagon-asks-congress-fund-mining-projects-australia-uk-2022-05-11.

46~ Horobin, William, and Arne Delfs. “France Accuses US of Pursuing China-Style Industrial Policy.” Bloomberg, Nov. 2022, www.bloomberg.com/news/articles/2022-11-22/france-accuses-us-of-pursuing-china-style-industrial-policy#xj4y7vzkg.

47~ “Xi Kicks off Campaign for a Chinese Vision of Global Security.” United States Institute of Peace, October 2022, www.usip.org/publications/2022/10/xi-kicks-campaign-chinese-vision-global-security.

48~ “China’s Global Security Initiative.” GMFUS, August 2022 www.gmfus.org/news/chinas-global-security-initiative.

49~ Skrdlik. “Duplicity and Destitution: Sierra Leone’s Artisanal Diamonds Fail to Benefit Local Communities.” The Mail & Guardian, 22 Nov. 2022, https://mg.co.za/africa/2022-11-22-duplicity-and-destitution-sierra-leones-artisanal-diamonds-fail-to-benefit-local-communities/

50~ Chinese in Beijing manage cobalt mines in Africa by remote control: study. (2022, December 7). South China Morning Post. https://www.scmp.com/news/china/science/article/3202385/chinese-using-mobile-phone-beijing-effectively-manage-cobalt-mines-africa-remote-control-study